Cryptocurrency settlements

What is the history of the P100 and what is the company. What does this entity bring to the cryptocurrency market and what customers does it address it to - says Piotr Stanio, CEO and co-founder of P100.

Piotr Stanio: Me and Adel Ghouma have been working together for 11 years. When we started our first project of our own, we both had a lot of experience in the field of new technologies and we were intrigued by the idea of a decentralized currency. Out of this curiosity, the Crypto Voucher project was born 8 years ago – a simple platform created for the purchase of cryptocurrencies. We have been observing this market from the beginning, we have gathered a lot of experience and knowledge, we have experienced many ups and downs.

Working on Crypto Voucher has shown us that there is a demand in the market for such services. We analyzed a lot of data and came to the conclusion that we have the technology and know-how, but we are currently operating in a niche part of this market. We naturally wanted to develop and we were looking for space. At the same time, we understood how complicated and daunting crypto is for beginners.

With this knowledge, we decided to create a company that would be an interface between cryptocurrencies and business and the world of traditional banking. We would like others to be able to easily build their services using cryptocurrencies. From the very beginning, the company had the goal of offering all our know-how and all the services we have built to companies, entrepreneurs, freelancers who want to use cryptocurrencies but do not know how to do it, or it is too much of a sacrifice of time, money, risk related to regulations, etc. for them.

What customer needs does the P100 take care of and how? What is the solution offered by the company?

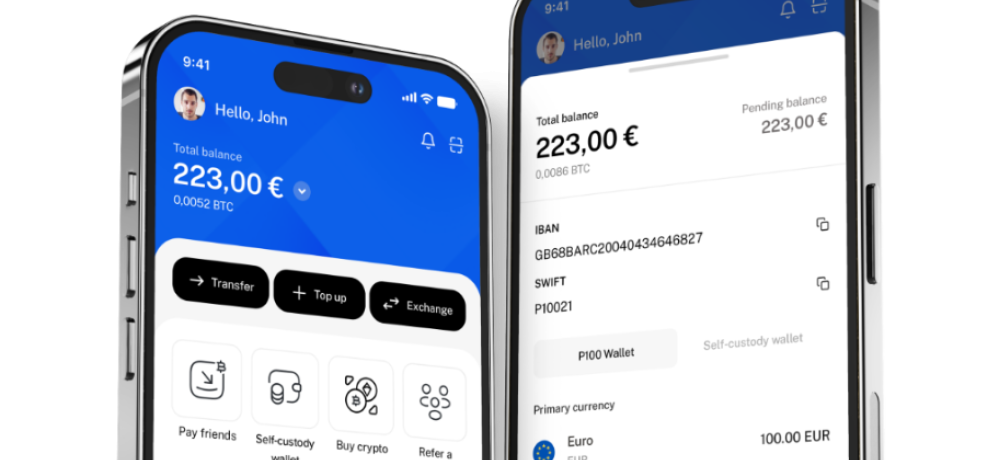

PS: Our solution is addressed to all entities that want to use cryptocurrencies in their business. The P100 is the interface between the blockchain and the world of traditional banking. It provides customers with an architecture on which they can build any cryptocurrency products such as crypto wallets, exchanges, deposits, withdrawals, transaction handling and settlement, etc.

The two main customer problems that the P100 solves are definitely reducing the cost of the infrastructure on which the crypto solution is based and offering a business payment account, which is very difficult to obtain in a traditional bank, especially for small and medium-sized businesses.

The P100 offers the trader a very low entry threshold, which allows micro, small and medium-sized companies to enter the crypto world more easily. Without having to invest in your own infrastructure or worry about regulations.

The number of use cases where the P100 is used is very large. The simplest of them is where the entrepreneur uses cryptocurrencies to settle accounts with his employees or contractors. Cryptocurrencies have a nice use in this case, because thanks to them we "escape" from banking costs and shorten the transaction time. For example, cryptocurrencies reach Brazil from Europe in a matter of seconds - the recipient has them in their account in no time.

Another example would be companies that are building their own versions of crypto/fiat wallets and are looking for infrastructure to create wallets, receive and send cryptocurrencies, or exchange crypto to fiat or fiat to crypto.

There are many possibilities of using the P100 crypto API. I think that if an entrepreneur is thinking about cryptocurrencies in his company, the P100 will definitely be able to help him with this.

Who is your customer?

PS: Any entity that wants to use cryptocurrencies in its business. Our main target are micro, small and medium-sized enterprises. Unlike the competition, the P100 does not require initial fees, nor minimum monthly or annual fees. Therefore, we will be an ideal choice primarily for startups and all those who have bounced off cryptocurrencies due to costs or legal risks.

What does your strategy for scaling your business look like? Which markets do you look at with particular favor and why?

PS: Already 8 years ago, since the beginning of our crypto activity, as founders we knew that cryptocurrencies really know no borders. In our current reality, the most important market for us is Europe, in particular Germany, the Netherlands, France, Spain, Italy. However, in the coming years, we look much further and want to deliver our solution globally. The scaling process certainly requires time and additional resources from the company.

So what does your fundraising story look like? What are your assumptions and needs?

PS: After starting P100, we knew that we needed support on two levels to develop quickly - know-how in the field of "traditional" banking and financial support.

And that's how we ended up at Digital Ocean Ventures, whose creators have experience in banking. It quickly became clear that we got along great, and Digital Ocean wanted to invest in the P100 at a very early stage. We made the decision to work together and build the product as soon as possible, and then, having a ready solution, go to the market with a view to raising funds for its further development.

We understand that in such a dynamic market, we need to scale quickly. We are currently talking to investors and partners who will allow us to do so and at the same time will be able to contribute their own know-how to the development of the company. We are not only concerned with capital, but also with experience and network.

What is special about the P100 in the cryptocurrency market?

PS: P100 is an interface between blockchain and the world of traditional banking, which helps entrepreneurs build solutions using cryptocurrencies, without having to delve into technicalities and legal issues.

The P100 provides an end-to-end solution combining a traditional business account for FIAT currencies with a crypto account, connected to an API to build your own crypto product.

Our particular advantage is also the very low entry threshold due to the lack of initial costs or minimum fixed fees.

Let's elaborate on the topic of regulations - in what regulatory framework do you operate and how does it improve the operation and perception of the company?

PS: In general, we are at an interesting moment when it comes to regulations in the area of cryptocurrencies. A lot has changed recently. Until a few years ago, it was the "wild west", the ALM 5 Directive was in force, which covered cryptocurrencies and imposed certain obligations. However, each country regulated it internally and imposed licenses. This lasted until now, until 2025, when a top-down regulation appeared at the EU level – the MiCA Regulation.

In short, it works in such a way that if a given entity obtains a license in a European Union country (from the local financial supervisory authority), it can legally operate throughout the EU.

This brings great benefits and opportunities, but also risks (regarding market overregulation). Therefore, when implementing MiCA regulations, it must be done sensibly.

However, from my perspective, the potential profits from such top-down regulations are much greater, because Europe will actually become the only place in the world that sets the rules for the cryptocurrency industry so specifically.

The very fact of having a license in the EU and a certain prestige associated with it opens doors to a company registered in the EU all over the world. Of course, you have to respect other regulations, local ones, but this European license is the most valuable.

I also hope that MiCA will make many companies that do not act in good faith have to cease their activities in Europe, or at least their operations will be hindered, so that this market will also clear up a bit.

What did you mean by the risk of overregulation?

PS: I will say this on a very specific example and there are a lot of them in the crypto world.

There is a "travel rule" in cryptocurrencies that says that every cryptocurrency transfer, just like in banking, that appears on the network must have an identified recipient and sender. If we are not able to identify the recipient of a given transfer, i.e. the transaction on the network is not signed, who sent it, then a whole range of obligations are imposed on us, which we as a platform must do to identify this payment.

We have to get a whole ton of declarations and papers from the user about the source of these cryptocurrencies for every transaction, for every cryptocurrency deposit, so this is the kind of thing that can scare customers away from European platforms and encourage them to go to platforms registered outside Europe.

Thank you for the interview

Interviewed by Ewa Pysiewicz, January 2025

P100 is the interface between the blockchain and the world of traditional banking. It provides customers with an architecture on which they can build any cryptocurrency products such as crypto wallets, exchanges, deposits, withdrawals, transaction handling and settlement, etc.

Piotr Stanio - an experienced manager and entrepreneur with many years of experience in e-commerce, technology and cryptocurrencies. He has been instrumental in the development of platforms such as G2A.com and Eneba.com, managing teams of over 100 people and growing global business operations.

As the co-founder and CEO of Crypto Voucher, he created a solution to facilitate the purchase of cryptocurrencies and is currently developing P100 – an app that connects finance with cryptocurrencies. Piotr specializes in business strategy, team management and introducing innovative products to global markets.